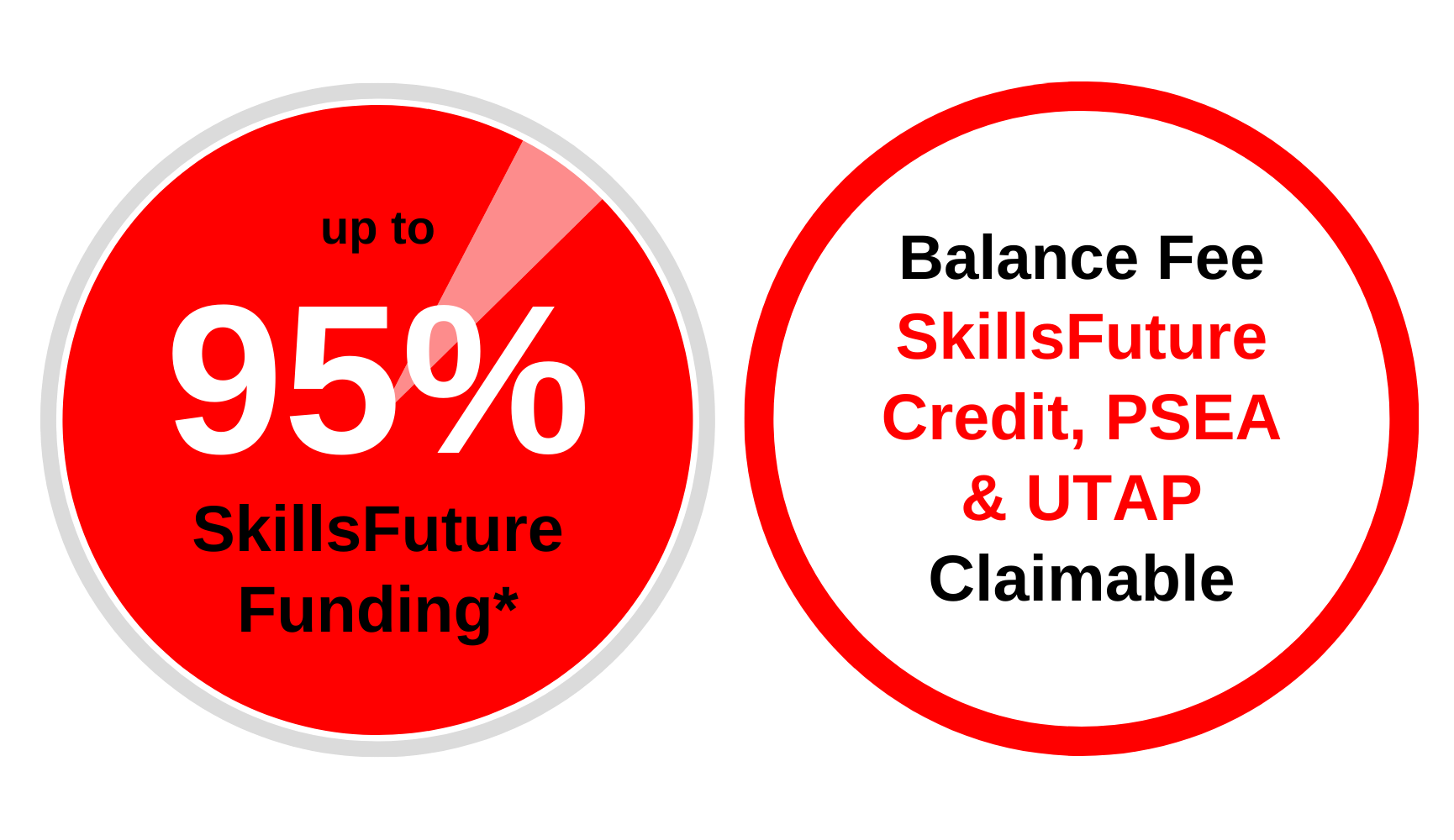

We offer various funding options for both certifiable (WSQ) and non-certifiable (non-WSQ) courses approved by SkillsFuture Singapore (SSG).

You can apply under the following grant schemes, whether sponsored by your company or as a self-sponsored individual:

These options provide ample opportunities for individuals and companies to access financial support for our courses.

Government funding for @ASK Training courses is available to Singapore Citizens, Permanent Residents, and Long-Term Visitor Pass Plus (LTVP+) holders.

You may qualify for course fee funding and training allowances if self-sponsored, as well as course fee and absentee payroll funding if sponsored by your employer for training purposes.

Additionally, if you are a mid-career Singaporean aged 40 and above, you are eligible for the SkillsFuture Mid-Career Enhanced Subsidy, offering increased subsidies for training courses to promote upskilling and reskilling initiatives.

We offer multiple convenient payment methods for your convenience:

Upon registering for a course, please refer to the invoice and payment instructions provided for further guidance.

Here are general steps you can follow:

1. Identify Eligibility:

Ensure that you or your organisation meet the eligibility criteria for the specific funding or subsidy. Factors such as age, employment status, course type, and other relevant criteria may apply.

2. Select a Course:

Choose a course that is eligible for government funding or subsidies. Different courses may have specific funding options available based on the type of training needed.

3. Apply for Funding:

Depending on the type of funding or subsidy, you may need to apply directly to the relevant authority or organisation. This could involve providing financial details, confirming eligibility, and following specific application guidelines.

4. Participate in Training:

Once your application is approved and funding is secured, enrol in the course and actively participate to benefit from the training provided.

5. Claim Subsidies:

If the training is employer-sponsored, understand the process for claiming subsidies or reimbursements after completing the course. This may involve submitting relevant documentation to the appropriate authority.

If you require further support or guidance, reach out to us and we’ll assist you!

Replacement of trainee: No Charge.

Rescheduling Policy:

Withdrawal Policy:

No course fee waiver is allowed for any absenteeism unless a valid reason is given within 2 working days after the course commences. No course fee waiver will be entertained for all courses held at hotels.

@ASK reserves the right to change the venue, cancel or postpone the class with prior notice, and a full refund will be provided for any withdrawal under such circumstances.

Upon completing the courses, you will earn both a SkillsFuture-Accredited WSQ certificate and a Certificate of Completion issued by @ASK Training, ensuring recognition of your newly acquired skills and knowledge.

For details regarding course fees, simply navigate to the individual course pages where you’ll find comprehensive information on pricing.

We offer various funding options for both certifiable (WSQ) and non-certifiable (non-WSQ) courses approved by SkillsFuture Singapore (SSG).

You can apply under the following grant schemes, whether sponsored by your company or as a self-sponsored individual:

These options provide ample opportunities for individuals and companies to access financial support for our courses.

Government funding for @ASK Training courses is available to Singapore Citizens, Permanent Residents, and Long-Term Visitor Pass Plus (LTVP+) holders.

You may qualify for course fee funding and training allowances if self-sponsored, as well as course fee and absentee payroll funding if sponsored by your employer for training purposes.

Additionally, if you are a mid-career Singaporean aged 40 and above, you are eligible for the SkillsFuture Mid-Career Enhanced Subsidy, offering increased subsidies for training courses to promote upskilling and reskilling initiatives.

We offer multiple convenient payment methods for your convenience:

Upon registering for a course, please refer to the invoice and payment instructions provided for further guidance.

Here are general steps you can follow:

1. Identify Eligibility:

Ensure that you or your organisation meet the eligibility criteria for the specific funding or subsidy. Factors such as age, employment status, course type, and other relevant criteria may apply.

2. Select a Course:

Choose a course that is eligible for government funding or subsidies. Different courses may have specific funding options available based on the type of training needed.

3. Apply for Funding:

Depending on the type of funding or subsidy, you may need to apply directly to the relevant authority or organisation. This could involve providing financial details, confirming eligibility, and following specific application guidelines.

4. Participate in Training:

Once your application is approved and funding is secured, enrol in the course and actively participate to benefit from the training provided.

5. Claim Subsidies:

If the training is employer-sponsored, understand the process for claiming subsidies or reimbursements after completing the course. This may involve submitting relevant documentation to the appropriate authority.

If you require further support or guidance, reach out to us and we’ll assist you!

Replacement of trainee: No Charge.

Rescheduling Policy:

Withdrawal Policy:

No course fee waiver is allowed for any absenteeism unless a valid reason is given within 2 working days after the course commences. No course fee waiver will be entertained for all courses held at hotels.

@ASK reserves the right to change the venue, cancel or postpone the class with prior notice, and a full refund will be provided for any withdrawal under such circumstances.

Upon completing the courses, you will earn both a SkillsFuture-Accredited WSQ certificate and a Certificate of Completion issued by @ASK Training, ensuring recognition of your newly acquired skills and knowledge.

1. Submit the online Registration form or Excel Registration form to @ASK and we will acknowledge your registration.

2. @ASK will provide you with Payment Advice for the course fee.

3. For WSQ-accredited courses, @ASK will apply for the SSG training grant on your behalf.

4. Course fee payment must be made before the start of the class. Any overdue amount will incur a daily interest of 12% per annum.

5. Payment methods include:

@ASK reserves the right to release the seat if you fail to pay the course fees at least 7 working days before the class start date.

For WSQ-accredited courses, you are entitled to the SSG training grant when you meet 75% of the training attendance and pass the requisite assessment. If you fail the assessment, you are required to re-take it immediately without additional fee.

Subsequent re-assessment is chargeable and is to be completed within a month. @ASK reserves the right to collect the full course fee from you if you fail the assessment.

1. Submit the online Registration form or Excel Registration form to @ASK.

2. If the course has no SDF grant or you do not intend to apply for the SDF grant, @ASK will raise an invoice with the full course fee after sending the Course Confirmation Letter (CCL) via email.

3. @ASK will apply for the SDF grant on your behalf via TPGateway (SSG grant portal).

4. Course fee payment has to be made before the start of the class. Any overdue amount will incur a daily interest of 12% per annum.

5. Payment methods include:

For WSQ-accredited courses, you are entitled to the SSG training grant when you meet 75% of the training attendance and pass the requisite assessment. If you fail the assessment, you are required to re-take it immediately without additional fee.

Subsequent re-assessment is chargeable and is to be completed within a month. @ASK reserves the right to collect the full course fee from you if you fail the assessment.

1. Submit the online Registration form or Excel Registration form to @ASK and we will acknowledge your registration.

2. @ASK will provide you with Payment Advice for the course fee.

3. For WSQ-accredited courses, @ASK will apply for the SSG training grant on your behalf.

4. Course fee payment must be made before the start of the class. Any overdue amount will incur a daily interest of 12% per annum.

5. Payment methods include:

@ASK reserves the right to release the seat if you fail to pay the course fees at least 7 working days before the class start date.

For WSQ-accredited courses, you are entitled to the SSG training grant when you meet 75% of the training attendance and pass the requisite assessment. If you fail the assessment, you are required to re-take it immediately without additional fee.

Subsequent re-assessment is chargeable and is to be completed within a month. @ASK reserves the right to collect the full course fee from you if you fail the assessment.

1. Submit the online Registration form or Excel Registration form to @ASK.

2. If the course has no SDF grant or you do not intend to apply for the SDF grant, @ASK will raise an invoice with the full course fee after sending the Course Confirmation Letter (CCL) via email.

3. @ASK will apply for the SDF grant on your behalf via TPGateway (SSG grant portal).

4. Course fee payment has to be made before the start of the class. Any overdue amount will incur a daily interest of 12% per annum.

5. Payment methods include:

For WSQ-accredited courses, you are entitled to the SSG training grant when you meet 75% of the training attendance and pass the requisite assessment. If you fail the assessment, you are required to re-take it immediately without additional fee.

Subsequent re-assessment is chargeable and is to be completed within a month. @ASK reserves the right to collect the full course fee from you if you fail the assessment.

The SkillsFuture Credit initiative in Singapore aims to foster lifelong learning among residents. It grants Singapore Citizens aged 25 and above an initial credit of $500, intended for approved courses that enhance skills and career prospects.

Additional top-up credits are provided to specific age groups, further incentivising upskilling efforts.

To offset course fees using SkillsFuture Credit, you can follow these steps:

1. Visit the MySkillsFuture website: Access the official MySkillsFuture portal.

2. Log in securely using SingPass: Use your SingPass credentials to log in to your account.

3. Select a Course: Browse through the available courses and choose one that aligns with your learning goals.

4. Apply for the Course: Once you’ve selected a course, follow the provided link to the ASK Training’s website and apply directly on our platform.

To check your remaining SkillsFuture credits, you can follow these steps:

1. Visit the MySkillsFuture Portal: Go to the official MySkillsFuture portal at MySkillsFuture.gov.sg.

2. Login with Singpass: Use your Singpass to securely access your account.

3. View Your Credit Balance: Navigate to the ‘SkillsFuture Credit’ section from the drop-down menu next to your name to view your current balance and transaction history.

Absolutely! You can combine your SkillsFuture Credit with other funding options or subsidies for eligible courses.

However, it’s crucial to review the terms and conditions of each funding source to ensure compatibility.

Feel free to reach out to us for clarification on combining funding sources for your specific course.

The SkillsFuture Credit initiative in Singapore aims to foster lifelong learning among residents. It grants Singapore Citizens aged 25 and above an initial credit of $500, intended for approved courses that enhance skills and career prospects.

Additional top-up credits are provided to specific age groups, further incentivising upskilling efforts.

To offset course fees using SkillsFuture Credit, you can follow these steps:

1. Visit the MySkillsFuture website: Access the official MySkillsFuture portal.

2. Log in securely using SingPass: Use your SingPass credentials to log in to your account.

3. Select a Course: Browse through the available courses and choose one that aligns with your learning goals.

4. Apply for the Course: Once you’ve selected a course, follow the provided link to the ASK Training’s website and apply directly on our platform.

To check your remaining SkillsFuture credits, you can follow these steps:

1. Visit the MySkillsFuture Portal: Go to the official MySkillsFuture portal at MySkillsFuture.gov.sg.

2. Login with Singpass: Use your Singpass to securely access your account.

3. View Your Credit Balance: Navigate to the ‘SkillsFuture Credit’ section from the drop-down menu next to your name to view your current balance and transaction history.

Absolutely! You can combine your SkillsFuture Credit with other funding options or subsidies for eligible courses.

However, it’s crucial to review the terms and conditions of each funding source to ensure compatibility.

Feel free to reach out to us for clarification on combining funding sources for your specific course.

The SkillsFuture Mid-Career Enhanced Subsidy (MCES) is designed to empower Singapore Citizens aged 40 and above to pursue continuous learning and adaptability in today’s ever-changing work landscape. This subsidy offers up to 90% funding support for certifiable (WSQ) courses at @ASK Training.

For instance, on a 16-hour course priced at $900, your payment is reduced to just $111.60 (including GST), with the remaining fees covered by SSG’s subsidy.

Any remaining balance of the course fees post-subsidy (e.g., $111.60) can be further offset using your SkillsFuture Credit, providing additional financial support for your continuous learning journey.

When enrolling in our certifiable (WSQ) course, please provide details regarding your residential status, age, and monthly income. This information is crucial for assessing your eligibility.

For individuals:

We will handle the MCES grant application on your behalf. Your role is simply to pay the nett fee, attend, and complete the course by passing the assessment.

For companies:

You will need to initiate the MCES grant application through TPGateway, after which we will provide our endorsement. Upon registration for a certifiable (WSQ) course, you will receive a comprehensive, step-by-step guide outlining the application process.

The SkillsFuture Mid-Career Enhanced Subsidy (MCES) is designed to empower Singapore Citizens aged 40 and above to pursue continuous learning and adaptability in today’s ever-changing work landscape. This subsidy offers up to 90% funding support for certifiable (WSQ) courses at @ASK Training.

For instance, on a 16-hour course priced at $900, your payment is reduced to just $111.60 (including GST), with the remaining fees covered by SSG’s subsidy.

Any remaining balance of the course fees post-subsidy (e.g., $111.60) can be further offset using your SkillsFuture Credit, providing additional financial support for your continuous learning journey.

When enrolling in our certifiable (WSQ) course, please provide details regarding your residential status, age, and monthly income. This information is crucial for assessing your eligibility.

For individuals:

We will handle the MCES grant application on your behalf. Your role is simply to pay the nett fee, attend, and complete the course by passing the assessment.

For companies:

You will need to initiate the MCES grant application through TPGateway, after which we will provide our endorsement. Upon registration for a certifiable (WSQ) course, you will receive a comprehensive, step-by-step guide outlining the application process.

The Enhanced Training Support for SMEs (ETSS) offers increased subsidies on course fees to support small and medium-sized enterprises (SMEs) further. SMEs can access SkillsFuture funding, covering up to 90% of course expenses when sending their employees to participate in SSG-supported courses.

Eligibility criteria for SMEs include:

– Incorporation or registration in Singapore.

– Employment size not exceeding 200 employees or annual sales turnover of no more than $100 million.

For trainees sponsored by SMEs:

– Must be Singapore Citizens or Singapore Permanent Residents.

– Employers must fully cover course expenses.

– Trainees should not be full-time national servicemen.

Additional Information: The ETSS scheme is open to various types of organisations, including non-business entities not registered with ACRA, such as VWOs and societies. However, Ministries, statutory boards, and other government agencies are not eligible for the Enhanced Training Support for SMEs Scheme. Sole proprietorships meeting all outlined criteria are also eligible.

To access the Enhanced Training Support for SMEs (ETSS) grant, employers need to enrol their employees in a certifiable (WSQ) course. Once the registration process is finalised, we will take care of the training grant application through SSG’s TPGateway portal on your behalf.

The Enhanced Training Support for SMEs (ETSS) offers increased subsidies on course fees to support small and medium-sized enterprises (SMEs) further. SMEs can access SkillsFuture funding, covering up to 90% of course expenses when sending their employees to participate in SSG-supported courses.

Eligibility criteria for SMEs include:

– Incorporation or registration in Singapore.

– Employment size not exceeding 200 employees or annual sales turnover of no more than $100 million.

For trainees sponsored by SMEs:

– Must be Singapore Citizens or Singapore Permanent Residents.

– Employers must fully cover course expenses.

– Trainees should not be full-time national servicemen.

Additional Information: The ETSS scheme is open to various types of organisations, including non-business entities not registered with ACRA, such as VWOs and societies. However, Ministries, statutory boards, and other government agencies are not eligible for the Enhanced Training Support for SMEs Scheme. Sole proprietorships meeting all outlined criteria are also eligible.

To access the Enhanced Training Support for SMEs (ETSS) grant, employers need to enrol their employees in a certifiable (WSQ) course. Once the registration process is finalised, we will take care of the training grant application through SSG’s TPGateway portal on your behalf.

Employers supporting their employees’ training can access funding for course fees and absentee payroll.

Approved certifiable courses recognised by SSG qualify for Absentee Payroll.

For SkillsFuture-approved certifiable (WSQ) courses, small and medium-sized enterprises (SMEs) are eligible to claim a fixed rate of $4.50 per training hour as absentee payroll, capped at $100,000 per enterprise per calendar year.

For example:

If your employee participates in a SkillsFuture-approved certifiable (WSQ) course with a cumulative duration of 19 training hours, the total reimbursement you can claim is 19 hours x $4.50 = $85.50.

Upon completion of the course, the designated CorpPass user from your company will be alerted to access the Enterprise Portal for Jobs & Skills (EPJS) using the provided credentials to declare the employment details of the trainee.

For additional details, you can consult the Absentee Payroll Claim Onboarding Guide.

Employers supporting their employees’ training can access funding for course fees and absentee payroll.

Approved certifiable courses recognised by SSG qualify for Absentee Payroll.

For SkillsFuture-approved certifiable (WSQ) courses, small and medium-sized enterprises (SMEs) are eligible to claim a fixed rate of $4.50 per training hour as absentee payroll, capped at $100,000 per enterprise per calendar year.

For example:

If your employee participates in a SkillsFuture-approved certifiable (WSQ) course with a cumulative duration of 19 training hours, the total reimbursement you can claim is 19 hours x $4.50 = $85.50.

Upon completion of the course, the designated CorpPass user from your company will be alerted to access the Enterprise Portal for Jobs & Skills (EPJS) using the provided credentials to declare the employment details of the trainee.

For additional details, you can consult the Absentee Payroll Claim Onboarding Guide.

SkillsFuture Enterprise Credit (SFEC) is a programme designed to encourage employers to invest in enterprise transformation and prioritise the enhancement of their workforce’s skills.

Eligible employers can receive a single credit of $10,000, which can be utilised to offset up to 90% of out-of-pocket expenses related to eligible costs or training programmes supported by SFEC.

Companies can use SFEC to subsidise out-of-pocket fees, such as net course fees, certification fees, and assessment fees, for SSG-funded courses.

For example:

Original Training Fee = $1,000

SSG Course Subsidy (90%) = $900

Remaining Out-of-Pocket Expense = $100

SFEC Assistance (90%) = $90

Employers must complete the submission of final claims for eligible programmes they have successfully applied for or training courses they have concluded by June 30, 2024, to the respective agencies. Employers must follow the claim procedures and prerequisites stipulated by relevant agencies for the endorsed programmes.

For courses eligible under SFEC, employers might need to submit SFEC claims through SkillsFuture Singapore’s dedicated SFEC microsite. For comprehensive guidelines on submitting SFEC claims, please refer to this guide.

Once claims for these supported programmes are approved, the corresponding credit will be calculated and distributed to employers’ registered GIRO accounts with IRAS or PayNow Corporate quarterly. No separate claim submission for SFEC is required.

SkillsFuture Enterprise Credit (SFEC) is a programme designed to encourage employers to invest in enterprise transformation and prioritise the enhancement of their workforce’s skills.

Eligible employers can receive a single credit of $10,000, which can be utilised to offset up to 90% of out-of-pocket expenses related to eligible costs or training programmes supported by SFEC.

Companies can use SFEC to subsidise out-of-pocket fees, such as net course fees, certification fees, and assessment fees, for SSG-funded courses.

For example:

Original Training Fee = $1,000

SSG Course Subsidy (90%) = $900

Remaining Out-of-Pocket Expense = $100

SFEC Assistance (90%) = $90

Employers must complete the submission of final claims for eligible programmes they have successfully applied for or training courses they have concluded by June 30, 2024, to the respective agencies. Employers must follow the claim procedures and prerequisites stipulated by relevant agencies for the endorsed programmes.

For courses eligible under SFEC, employers might need to submit SFEC claims through SkillsFuture Singapore’s dedicated SFEC microsite. For comprehensive guidelines on submitting SFEC claims, please refer to this guide.

Once claims for these supported programmes are approved, the corresponding credit will be calculated and distributed to employers’ registered GIRO accounts with IRAS or PayNow Corporate quarterly. No separate claim submission for SFEC is required.

The Post-Secondary Education Account (PSEA) in Singapore is a scheme administered by the Ministry of Education (MOE). PSEA funds are available for Singaporean Citizens to cover the approved charges related to WSQ programmes. The PSEA account will be closed in the year the account holder reaches 31 years of age, and any remaining funds in the PSEA will be transferred to the account holder’s CPF.

To check your PSEA account balance, call the 24-hour automated Edusave/PSEA hotline at 6260 0777 and input your NRIC number.

To access your PSEA Funds:

1. Dial MOE’s 24-hour PSEA Automatic Hotline at 6260 0777 to check your account balance.

2. Register for the course and obtain the course code from our course administrators.

3. Depending on your withdrawal preference, access the appropriate link to submit a withdrawal form:

4. If there is any remaining balance after deducting your available PSEA funds, you can settle the outstanding payment through iBanking, PayNow, Credit Card, or Cheque.

5. Instructions on claiming your PSEA funds will also be provided in the registration confirmation email you receive after signing up.

Important Reminder: Submit your claim at least 1 month before the course’s commencement date. Missing this deadline requires using an alternative payment method to secure your spot in the course. After the disbursement of your PSEA funds to us, we will initiate the refund process.

The Post-Secondary Education Account (PSEA) in Singapore is a scheme administered by the Ministry of Education (MOE). PSEA funds are available for Singaporean Citizens to cover the approved charges related to WSQ programmes. The PSEA account will be closed in the year the account holder reaches 31 years of age, and any remaining funds in the PSEA will be transferred to the account holder’s CPF.

To check your PSEA account balance, call the 24-hour automated Edusave/PSEA hotline at 6260 0777 and input your NRIC number.

To access your PSEA Funds:

1. Dial MOE’s 24-hour PSEA Automatic Hotline at 6260 0777 to check your account balance.

2. Register for the course and obtain the course code from our course administrators.

3. Depending on your withdrawal preference, access the appropriate link to submit a withdrawal form:

4. If there is any remaining balance after deducting your available PSEA funds, you can settle the outstanding payment through iBanking, PayNow, Credit Card, or Cheque.

5. Instructions on claiming your PSEA funds will also be provided in the registration confirmation email you receive after signing up.

Important Reminder: Submit your claim at least 1 month before the course’s commencement date. Missing this deadline requires using an alternative payment method to secure your spot in the course. After the disbursement of your PSEA funds to us, we will initiate the refund process.

The Enhanced Workfare Skills Support (WSS) scheme aims to expand access to WSS for lower-wage workers, allowing them to upskill earlier in their careers and encourage deeper and more sustained training among lower-wage workers.

Eligible individuals can benefit from:

To qualify for the enhanced WSS scheme, individuals must meet the following criteria:

Starting January 2023, WSS eligibility can be checked through the Workfare eService using SingPass. A WSS letter is not required for course enrollment with Training Providers.

Training Commitment Award (TCA)

Qualified individuals are eligible for cash rewards. Trainees will receive $800 upon completion of a single WSQ Qualification or Academic CET Qualification. Additionally, they will receive $100 for any two of the following courses: WSQ Statement of Attainment (SOA), Academic CET Modular Certificate/Post-Diploma Certificate, and Other certifiable courses supported by SSG. This amount is capped at $200.

Please note that course completion must occur within the trainee’s eligibility period, with a maximum cap of $1,000 per WSS Eligibility year.

No application process is necessary. Individuals will be informed about their Training Commitment Allowance (TCA) payment through SMS and/or a letter from the CPF Board. It might take 1 to 3 months for you to receive the payment.

The Enhanced Workfare Skills Support (WSS) scheme aims to expand access to WSS for lower-wage workers, allowing them to upskill earlier in their careers and encourage deeper and more sustained training among lower-wage workers.

Eligible individuals can benefit from:

To qualify for the enhanced WSS scheme, individuals must meet the following criteria:

Starting January 2023, WSS eligibility can be checked through the Workfare eService using SingPass. A WSS letter is not required for course enrollment with Training Providers.

Training Commitment Award (TCA)

Qualified individuals are eligible for cash rewards. Trainees will receive $800 upon completion of a single WSQ Qualification or Academic CET Qualification. Additionally, they will receive $100 for any two of the following courses: WSQ Statement of Attainment (SOA), Academic CET Modular Certificate/Post-Diploma Certificate, and Other certifiable courses supported by SSG. This amount is capped at $200.

Please note that course completion must occur within the trainee’s eligibility period, with a maximum cap of $1,000 per WSS Eligibility year.

No application process is necessary. Individuals will be informed about their Training Commitment Allowance (TCA) payment through SMS and/or a letter from the CPF Board. It might take 1 to 3 months for you to receive the payment.

The Skills Development fund is automatically granted for all SkillsFuture accredited courses. Singaporeans and PRs are eligible for this grant entitlement at $2/hour of training.

For example:

If your employee participates in a SkillsFuture-approved certifiable (WSQ) course with a cumulative duration of 14 training hours, the total reimbursement you can claim is 14 hours x $2 = $28.

The Skills Development fund is automatically granted for all SkillsFuture accredited courses. Singaporeans and PRs are eligible for this grant entitlement at $2/hour of training.

For example:

If your employee participates in a SkillsFuture-approved certifiable (WSQ) course with a cumulative duration of 14 training hours, the total reimbursement you can claim is 14 hours x $2 = $28.

UTAP is a training benefit for NTUC members to defray their cost of training. This benefit is to encourage more NTUC members to go for skills upgrading.

NTUC members enjoy 50% *unfunded course fee support for up to $250 each year when you sign up for courses supported under UTAP. NTUC members aged 40 and above can enjoy higher funding support up to $500 per individual each year, capped at 50% of unfunded course fees, for courses attended between 1 July 2020 to 31 December 2025.

*Unfunded course fee refers to the balance course fee payable after applicable government subsidy. This excludes GST, registration fees, misc. fees etc.

All NTUC members can apply for the Union Training Assistance Programme (UTAP). However, to be eligible for UTAP, the following criteria must be met:

1. Union member must commence the course within the UTAP approved period.

2. Union member must achieve minimum attendance for the course based on existing Government regulations and sit for all prescribed examination(s) if any.

3. Union member must submit claims via the UTAP system within 6 months after course completion.

4. Union member must not claim full funding through company sponsorship or other types of funding.

5. Union member must have paid-up union membership before course commencement, throughout the entire course duration, and at the point of claim.

*Unfunded course fee refers to the balance course fee payable after applicable government subsidy. This excludes GST, registration fees, misc. fees etc.

To check your NTUC membership status, you can:

To apply for the Union Training Assistance Programme (UTAP) as an NTUC member, follow these steps:

UTAP is a training benefit for NTUC members to defray their cost of training. This benefit is to encourage more NTUC members to go for skills upgrading.

NTUC members enjoy 50% *unfunded course fee support for up to $250 each year when you sign up for courses supported under UTAP. NTUC members aged 40 and above can enjoy higher funding support up to $500 per individual each year, capped at 50% of unfunded course fees, for courses attended between 1 July 2020 to 31 December 2025.

*Unfunded course fee refers to the balance course fee payable after applicable government subsidy. This excludes GST, registration fees, misc. fees etc.

All NTUC members can apply for the Union Training Assistance Programme (UTAP). However, to be eligible for UTAP, the following criteria must be met:

1. Union member must commence the course within the UTAP approved period.

2. Union member must achieve minimum attendance for the course based on existing Government regulations and sit for all prescribed examination(s) if any.

3. Union member must submit claims via the UTAP system within 6 months after course completion.

4. Union member must not claim full funding through company sponsorship or other types of funding.

5. Union member must have paid-up union membership before course commencement, throughout the entire course duration, and at the point of claim.

*Unfunded course fee refers to the balance course fee payable after applicable government subsidy. This excludes GST, registration fees, misc. fees etc.

To check your NTUC membership status, you can:

To apply for the Union Training Assistance Programme (UTAP) as an NTUC member, follow these steps:

Fill in the form below and our programme consultants will get back to you!